Qurrex is the first hybrid cryptocurrency integrating the industrial infrastructure of traditional stock exchanges with a decentralized network. What does this mean? Qurrex is combining a centralized industry platform with a decentralized blockchain protocol in which the centralized exchange will serve as one of the nodes.

Qurrex wants to provide high-performance trading and win the trust of professional stock exchange players by substantially increasing the market’s liquidity. Why is this liquidity so important? Today, when traders pick a crypto exchange, they focus on its transparency, security, and most importantly, its liquidity. High liquidity is required to enable traders to do marginal trading. According to Qurrex, each exchange manages to address a couple of concerns. However, currently, no exchange addresses all concerns.

Key Selling Points of Qurrex

- Highly secure & high performance: Qurrex can offer high-speed data connectivity, and fast, high-volume trading; because its decentralized exchange and blockchain network should eliminate middlemen from the trading process. The system is designed to serve professionals with architecture that meets financial industry standards.

- Up to 70,000 transactions per second.

- Hybrid infrastructure, integrating centralized and decentralized exchanges.

- Broad functionality to support the wishes of all types of traders.

- Maximum transparency by enabling regular independent audits and publication of financial accounts.

- Payment gateway for depositing and withdrawing fiat money.

- The interface is highly customizable and comes with an advanced API.

- Availability of a social trading platform where people can rate trade strategies, use a transaction copying service, and find info on trading algorithms and embedded scripts.

As you can see, the platform is aimed at a wide circle of users: from investors who have only just entered the market, to big brokers and institutional investors.

Qurrex’s Background

In November 2016, a group of like-minded people began work on the first hybrid cryptocurrency exchange with an added flavor of social trading and investing. The team consists of experts who have years of experience working in currency markets, developers of trade terminals, and founders of successfully operating stock and futures exchanges. They all saw the significant potential in applying the best practices of the traditional sector to the cryptocurrency space.

Token Usage

Token Usage for Central Exchange: The token can be used to retrieve a discount for paying commission fees for executing trades. In addition, it acts as a medium for paying services and fees with other currencies. And lastly, the Qurrex token is a quoted exchange commodity.

Token Usage for Decentralized Exchange: The token can be used for other tasks on the decentralized exchange, like an inflationary growth of the token’s value and commission fees.

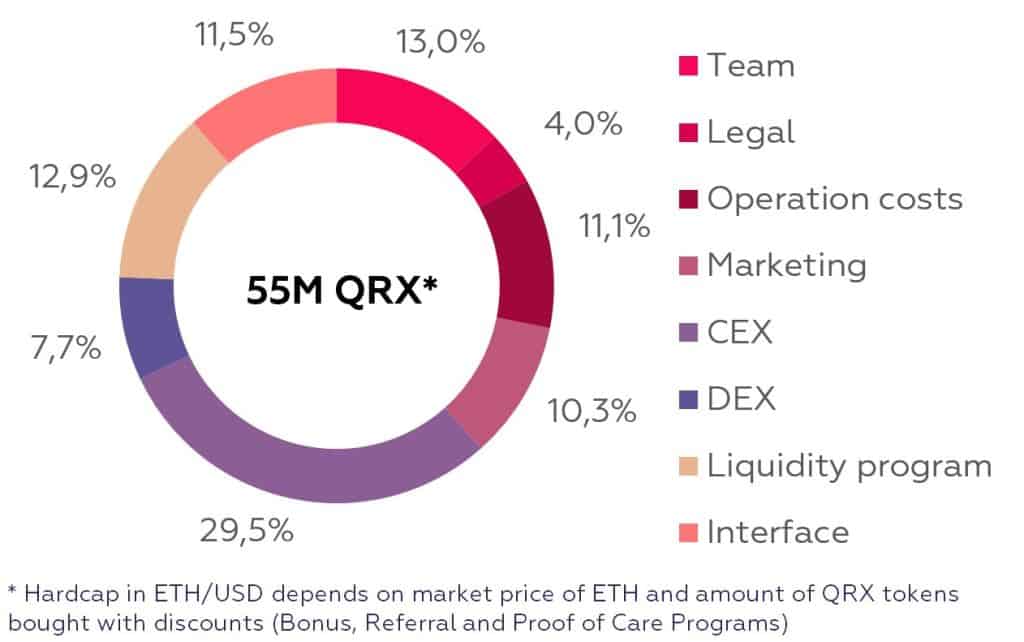

Crowdsale funds distribution:

Other Qurrex Functionality

Qurrex offers some other functionality like personal money management settings. This is the ability to strictly limit the trading leverage on the account within a certain brokerage value. In general, these settings are more relevant and diverse in the service of trade signals. There, restrictions are placed on the leverage of the trade (transaction) / manager / portfolio or the entire account.

Qurrex will provide a web trading terminal and API. With these tools, you can build your own algorithmic trading app right in this terminal. Other exchanges provide an API as well, but generally, APIs don’t meet the requirements of traders, for example: If you send more than 3 requests at once, the server considers it as DDOS. However, some trading bots require such a high amount of requests.

Qurrex’s Team

Matthijs Johan Lek: Mathijs has worked in finance for 20 years, including investment banking, brokerage at Rabobank (Dutch bank), and business development. He is the founder and CEO of Qurrex, managing a team of traders and advisors.

Slava Baikalov: Slava has more than 10 years of experience in corporate finance, investment banking, and investment analysis. He is the chief operating officer (COO) as well as a co-founder. A few years ago, he became hooked on crypto and started trading crypto.

Andrey Sitaev: Andrey is the chief technology officer (CTO). He manages a team of 17 frontend and backend developers. Andrey has a lot of experience with the .NET framework – as you can see on his Github profile. His team is focusing on .NET to implement margin trading algorithms. Before Qurrex, Andrey led the development of a Forex analytical / trading platform called TradeSharp.

Konstantin Sviridenko: Konstantin has great experience coding trading systems and financial instruments at stock exchanges. He has worked at St. Petersburg Stock Exchange, Investment System Voskhod and the Ukrainian Exchange). He will help to build the platform from scratch.

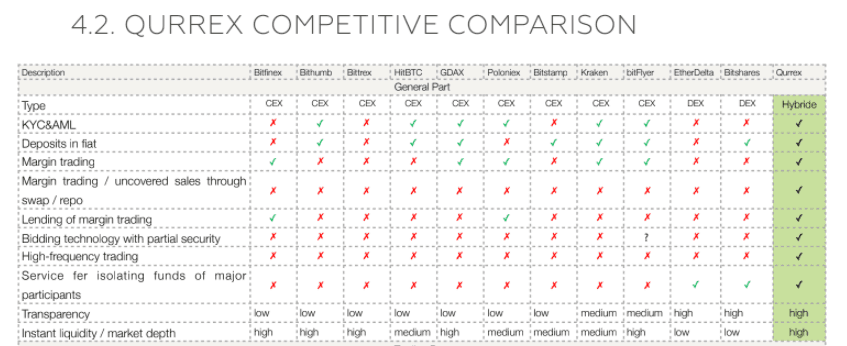

Competitors

As you can see, every exchange is considered to be a competitor. However, no single exchange succeeds in meeting all requirements of its traders. You can find the full comparison here.

Kraken is considered to be one of the biggest competitors based on the functionality they offer, although they miss a lot of important functionality. Why Kraken scores well?

- Have KYC & AML integrated

- Enable fiat deposits

- Offer margin trading

- Mobile version of the website is available

- Full range of trading orders

Cons

It’s not an easy challenge to provide the first hybrid exchange. We have some doubts about the security of such an integration attempting to use centralized exchanges central over a decentralized blockchain. They try to offer a lot of functionality at once, although they have spread it over a long roadmap.

Roadmap

Development on the project started in November 2016 at their own expense. At the moment, Qurrex has developed a minimum viable version of their trading terminal which allows users to conclude deals, apply technical analysis tools and view data feeds. The core architecture has integrated the ability to execute requests in the CEX or DEX.

- Phase 1: Testing and launch of organized trades on the CEX

Reference point: 1st half of 2019Qurrex wants to have an office in Europe to receive a payment license to carry out activities in the EU. In addition, they want to develop basic functionality for the social trading platform like a chat, a forum, and the ability to share charts, reporting, and forecasts. - Phase 2: Expansion of the CEX functionality and launch of the decentralized network

Reference point: 2nd half of 2019Qurrex wants to start with stress testing the decentralized trading platform and also allow customers on the hybrid exchange platform. These users should be able to access the aggregated liquidity from all nodes of the decentralized network, including liquidity from the centralized exchange.

Conclusion

It’s a great idea to offer a hybrid exchange, although we are little concerned about the security and decentralization aspect. Depending on the competitor analysis, Qurrex has the potential to become a very large exchange, used by many traders. They try to serve all kinds of traders: people who want to create advanced trading bots, use trading signals, or even people who are not as strong at trading and prefer to use the social trading platform. It’s a long-term project to watch for sure.

ICO Details & More info

Token symbol: QRX

Total token supply: 70m

Total token for sale: 55m

Total token for pre-sale: 17m

Period of public pre-sale: 27 February – 27 March 2018

Period of sale: 02 April – 16 April

Country of incorporation – Cayman Islands

Komentar

Posting Komentar