Black will use the blockchain to transfer risk directly from clients

(insureds) to financial backers (Black Syndicate Token holders):

- minimizing all inefficiencies

- storing all data securely in blockchains

- transparent business operations using smart contracts

- faster innovation by platform members

Black will fix the insurance industry fundamentally. Black is an insurance platform like Lloyds of London on blockchain without the expense, delays and bureaucracy that we witness today.

Insurance business will be generated by local MGAs / Brokers / Agents whose responsibility is designing insurance products for a market, pricing and selling the product and organizing claims handling. Delegating business to local agents makes the Black business model scalable while bringing business decisions closer to end customers.

Black Insurance will use two types of tokens:

=> Black Platform Token (BLCK). BLCK empowers foundations, provides access to platforms and leads voting on system updates to platforms (utility tokens). All platform users will use BLCK to oversee insurance on the Black platform, and interest for BLCK will increase as more insurance businesses are directed to the platform.

=> Black Syndicate Tokens (BST) (issued when platform is set up). BST is an investment in insurance capital, and a special BST is created for each syndicate (security token), Productivity insurance portfolio for a particular syndicate will go into its holders BST.

Black Platform Token (BLCK). BLCK powers the infrastructure, providing access to the platform and for conducting voting on system updates to the platform (utility token). All platform users will use BLCK for managing insurance on the Black platform, and demand for BLCK will increase as more insurance business is conducted on the platform.

Black Syndicate Tokens (BST) (issued when the platform is ready). BST is an investment in insurance capital, and a specific BST is created for each syndicate (security token), The profitability of the insurance portfolio for a specific syndicate will pass-through to the holders of it’s BST.

BLCK and all BST type markers can move between Public Ethereum and private black platforms using Token Gateways series. BLCK is consumed on a private black platform, and BST tokens are produced on a private black platform when Syndicate is funded by Investors. Both types of tokens can be transferred to the Common Ethereum, so you can transfer them to check with other users of Ethereum, which can not be Black platform users, or may not have direct access to the current Black Platform (new user Platform Platform). All of our tokens are closely related to the private black platform as the primary market, so the Ethereum General is included in this decision as a secondary market for our sign.

ICO Structure

- The beginning of the pre-sale: July 31, 2013

- Pre-sale period: 30

- Pre-sale helmet: $ 15,000,000.00

- Terms of pre-sale: the first week of the bonus is 25%, and the bonus for the first week is 20%

- Sale goods Beginning: 31.08.2012

- Selling current: 30 days

- Soft cover: $ 2,000,000.00

- Hard cover: $ 45,000,000.00

- Token symbol: BLCK

- Number of tokens: 471 082 090

- Exchange rate: 1BLCK = 0.2 USD

- Minimal purchase: USD 100.00

- Cryptos Received: BTC, LTC, ETH

- Adjustments: Unsigned tokens will be destroyed by a token contract.

- Listing: BLCK token will be specified on crypto-exchanges

- Advantages of Token Holder: BLCK can be used to pay for services on the Black platform. Black guarantees that before January 1, 2021, the service fee paid by BLCK will be at least 20% cheaper than fees paid in other currencies.

- Trading Token Restrictions: only teams and advisers have a transition period and a lock.

Black collects fees from users for using platforms for a variety of actions. For example: syndicate funding insurance products with capital. The cost of Black Insurance will be% of GWP (Gross Written Premium). Charges to be paid in BLCK tokens.

The Black Foundation will sell tokens in the market to cover operating costs: Development, HR, admin, law & marketing. Excess tokens will be stored in the company reserve for occasions when costs rise and platform usage is lower.

The foundation reserve will have a top level. Once this level is reached, we will decide what to do with the surplus. Some potential options are:

- Invest to enter new markets

- Invest in the expansion and growth of the user base

- Share to platform user wallet as a bonus

- Burn token

The Black Foundation will sell tokens in the market to cover operating costs: Development, HR, admin, law & marketing. Excess tokens will be stored in the company reserve for occasions when costs rise and platform usage is lower.

The foundation reserve will have a top level. Once this level is reached, we will decide what to do with the surplus. Some potential options are:

- Invest to enter new markets

- Invest in the expansion and growth of the user base

- Share to platform user wallet as a bonus

- Burn token

Roadmap

Some major milestones for Roadmap application development:

=> Mar 2018 — Prototype — Platform technology demo using Fabric + Composer

=> May 2018 — MVP -Demo ready for Investors

=> August 2018 — Alfa-Platform accepts First Users

=> May 2019 — v1.0 — EU licensed Insurance Company, sells a new Policy

=> Apr 2018 — Whitepaper — Released to Public

=> Jun 2018 — ICO — Black DAO launched in Ethereum

=> December 2018 — Beta — Platform accepts New products

Some major milestones for Roadmap application development:

=> Mar 2018 — Prototype — Platform technology demo using Fabric + Composer

=> May 2018 — MVP -Demo ready for Investors

=> August 2018 — Alfa-Platform accepts First Users

=> May 2019 — v1.0 — EU licensed Insurance Company, sells a new Policy

=> Apr 2018 — Whitepaper — Released to Public

=> Jun 2018 — ICO — Black DAO launched in Ethereum

=> December 2018 — Beta — Platform accepts New products

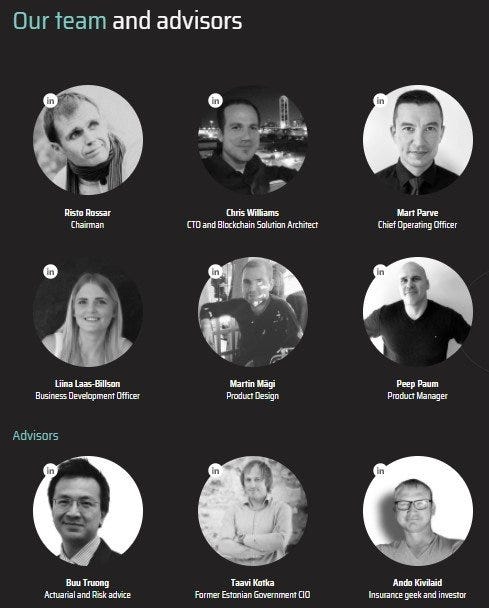

Team

The team consists of veterans of the insurance industry and blockchain experts. It is a great blend of knowledge in the insurance industry, expertise in blockchain technology and crypto space. The founder has over 18 years of experience in insurance software and sees the urgent need for solutions that will democratize the field through technology.

The team consists of veterans of the insurance industry and blockchain experts. It is a great blend of knowledge in the insurance industry, expertise in blockchain technology and crypto space. The founder has over 18 years of experience in insurance software and sees the urgent need for solutions that will democratize the field through technology.

For more information, please visit our official address at:

Website: https://www.black.insure/

White Paper: http://www.black.insure/whitepaper/

Twitter: https://twitter.com/BlackInsure

Facebook: https://www.facebook.com/blackinsure

Telegram: https://t.me/blackinsurebot

Bitcointalk: https://bitcointalk.org/index.php?topic=3372186.new#new

Linkedin: https://www.linkedin.com/company/black-insurance/

White Paper: http://www.black.insure/whitepaper/

Twitter: https://twitter.com/BlackInsure

Facebook: https://www.facebook.com/blackinsure

Telegram: https://t.me/blackinsurebot

Bitcointalk: https://bitcointalk.org/index.php?topic=3372186.new#new

Linkedin: https://www.linkedin.com/company/black-insurance/

Komentar

Posting Komentar